I agree to and consent to receive news, updates, and other communications by way of commercial electronic messages (including email) from Augusta Gold Corp. I understand I may withdraw consent at any time by clicking the unsubscribe link contained in all emails from Augusta Gold Corp.

Augusta Gold Acquires Fully Permitted Low-cost Heap Leach Gold Project Seven Miles From Its Bullfrog Project in Nevada

Vancouver, British Columbia, April 21, 2022 – Augusta Gold Corp. (TSX:G; OTCQB:AUGG; FSE:11B) (“Augusta Gold” or the “Company”) is pleased to announce that it has entered into an agreement to acquire the Reward Project, located just seven miles from the Company’s Bullfrog Project in Nevada (the “Transaction”).

Reward Project Highlights

- Historical estimate1 of measured and indicated mineral resources of 416,8002 ounces (oz) of oxide gold grading 0.022 oz/t (0.75 g/t) gold

- Historical estimate of proven and probable reserves of 377,0003 oz of gold grading 0.024 oz/t (0.82 g/t) gold

- Historical estimate test work projected gold recoveries of 81%

- Project has all required permits in place for construction

- Augusta Gold anticipates developing the Reward Project as soon as historical estimates are updated

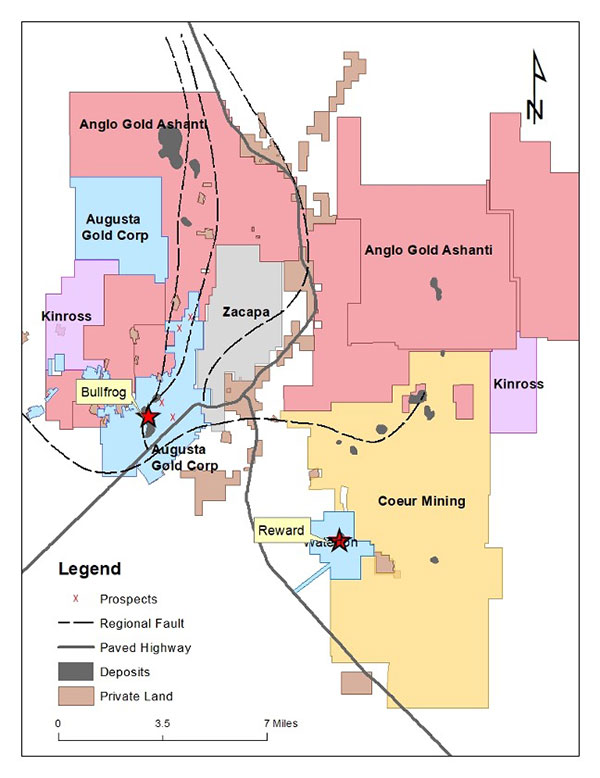

The Reward Project has a historical measured and indicated mineral resource estimate of 416,800 ounces (oz) of oxide gold grading 0.022 oz/t (0.75 g/t) gold, a historical proven and probable mineral reserve estimate of 377,000 oz of gold grading 0.024 oz/t (0.82 g/t) gold, and has received the necessary permits to proceed to construction of the project. Test work developed for the historical estimate projected gold recoveries of 81%. The Company plans to immediately undertake work to update the historical estimates with development of the Reward Project anticipated to follow shortly thereafter. The Reward Project fits well with the Company’s Bullfrog Project (seven miles to the northwest – see Figure 1), which contains measured and indicated mineral resources of 1,209,0004 ounces of gold at a grade of 0.53 g/t gold, and inferred mineral resources of 258,000 ounces of gold at a grade of 0.48 g/t gold. It is anticipated that significant synergies can be realized between the projects.

Figure 1

Don Taylor, President and CEO commented: “We are pleased to bring the Reward Project into our ongoing operations being advanced at the Bullfrog Project. Once we have updated past studies, we anticipate that the Reward Project will be a shovel ready, low-risk oxide gold project in close proximity to our Bullfrog Project that will enable the Company to be a near-term producer while we complete the permitting process at Bullfrog.”

Reward Project Acquisition

Augusta Gold will purchase the Reward Project from Waterton Nevada Splitter LLC (“Waterton”) for the following consideration:

- US$12.5M cash paid on closing of the Transaction (“Closing”) with cash on hand;

- US$15.0M comprised of 7,800,000 Augusta Gold shares paid on Closing with the remaining payable at the time of Augusta Gold’s next equity financing, in cash or Augusta Gold shares, provided the additional amount of shares does not result in Waterton owning more than 9.99% of Augusta Gold’s issued and outstanding shares; and

- US$17.5M cash paid within 90 days of Closing (the “Deferred Payment”), which is backstopped by the Company’s Executive Chairman and significant shareholder, Mr. Richard Warke.

Closing of the Transaction is subject to several conditions, including receipt of all required regulatory approvals.

Reward Project Historical Estimate

The historical mineral resource and reserve estimates are based upon a technical report titled, “Reward Project Feasibility Study NI 43-101 Technical Report Nevada, USA” with an effective date of September 6, 2019 that was not filed on SEDAR. The historical estimates are considered to be relevant and reliable for the purposes of the Company proceeding with the Transaction as it provides an indication of the potential of the Reward Project. Furthermore, the historical estimates do use categories of mineral reserves and resources as provided for in National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and comprise the most recent report available to the Company. The historical estimates need to be updated to include work done since the date of the estimates and to use assumptions and qualifications that are more reflective of today’s environment. For instance, the gold price is no longer current, and inflation will have affected other cost estimates.

A qualified person has not done sufficient work to classify the historical estimates as current mineral resources and reserves and the Company is not treating the historical estimates as current mineral resources and reserves.

Below are excerpts of the historical estimates from the technical report.

Historical Mineral Resource Statement

| Classification | Cut-off Grade oz/st Au | Tonnage

st |

Average Grade oz/st Au | Contained Au

Oz |

| Good Hope | ||||

| Measured Indicated M&I Total |

0.006 0.006 0.006 |

6,694,000 11,249,000 17,943,000 |

0.025 0.021 0.022 |

168,800 233,000 401,800 |

| Inferred | 0.006 | 262,000 | 0.016 | 4,300 |

| Gold Ace | ||||

| Indicated Inferred |

0.006 0.006 |

805,000 917,000 |

0.019 0.022 |

14,900 19,900 |

| Combined Good Hope and Gold Ace | ||||

| Measured Indicated M&I Total |

0.006 0.006 0.006 |

6,694,000 12,054,000 18,748,000 |

0.025 0.021 0.022 |

168,800 247,900 416,800 |

| Inferred | 0.006 | 1,179,000 | 0.021 | 24,200 |

Notes:

- The Historical Mineral Resources are inclusive of the Historical Mineral Reserves herein;

- The effective date of the mineral resource estimate is October 31, 2018.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that any part of the Mineral Resources estimated will be converted into Mineral Reserves;

- Historical Resources stated as contained within a potentially economically minable open pit; pit optimization was based on an assumed gold price of US$1,400/oz, modeled recovery averaging 80.8% for gold, an ore mining cost of US$2.00/st, an ore processing cost of US$5.00/st; with pit slopes ranging from 48° to 58°;

- Resources are reported using a lower cut-off of 0.006 oz/st contained gold CoG;

- Numbers in the table have been rounded to reflect the accuracy of the estimate and may not sum due to rounding.

Historical Mineral Reserve Statement

| Tons Kst |

Grade oz/st Au |

Contained Ounces Koz Au |

|

| Proven | 6,383 | 0.026 | 167 |

| Probable | 9,643 | 0.022 | 210 |

| Proven and Probable | 16,025 | 0.024 | 377 |

Notes:

- Historical Proven and Probable reserves were estimated by Thomas L. Dyer, P.E. of Mine Development Associates using the 2014 CIM Definition Standards.

- The effective date of the reserves is March 26, 2019.

- Historical Mineral Reserves were estimated based on a gold price of US $1,300/oz, and reported using a 0.007 oz/st Au cut-off grade.

- Rounding of values may cause some apparent discrepancies.

Qualified Person

The scientific and technical information contained in this news release related to the historical estimates at the Reward Project is based upon disclosure prepared by David Evans, Neil Lincoln, Timothy D. Scott, Mark Willow, Jim Cremeens, Michael Dufresne, and Thomas Dyer who are “Qualified Persons” under NI 43-101. The scientific and technical information contained in this news release related to the Bullfrog Project resource estimate is based upon the technical report titled, “NI 43-101 Technical Report Mineral Resource Estimate Bullfrog Gold Project Nye County, Nevada” with an effective date of December 31, 2021, and prepared by Russ Downer and Adam House who are “Qualified Persons” under NI 43-101. The remaining scientific and technical information contained in this news release has been reviewed and approved by Donald Taylor, who is a “Qualified Person” under NI 43-101. Mr. Taylor reviewed the report containing the historical estimates and determined that the conclusions appeared reasonable based on the time of the report. He was not able to independently verify any of the underlying data contained in the report. Further work will be conducted following Closing.

Inquiries

Telephone: 604-638-1468

Email: info@augustagold.com

About Augusta Gold

Augusta Gold is an exploration and development company focused on building a long-term business that delivers stakeholder value through developing the Bullfrog Gold Project and pursing accretive M&A opportunities. The Bullfrog Gold Project is located in the prolific Bullfrog mining district approximately 120 miles north-west of Las Vegas, Nevada and four miles west of Beatty, Nevada. The Company controls approximately 5,554 hectares of mineral rights including the Bullfrog and Montgomery-Shoshone deposits and has further identified significant additional mineralization around the existing pits and defined several exploration targets that could further enhance the Project. The Company is led by a management team and board of directors with a proven track record of success in financing and developing mining assets and delivering shareholder value. For more information, please visit www.augustagold.com.

Forward Looking Statements

Certain statements and information contained in this new release constitute “forward-looking statements”, and “forward-looking information” within the meaning of applicable securities laws (collectively, “forward-looking statements”). These statements appear in a number of places in this new release and include statements regarding our intent, or the beliefs or current expectations of our officers and directors, including plans to update the historical estimates; plans to move towards developing the Reward Project; that the Company will acquire the Reward Project and the terms of such acquisition; estimates of mineral resources and mineral reserves; that significant synergies can be realized between the projects; that Mr. Warke will backstop the Deferred Payment to the extent necessary. When used in this news release words such as “to be”, "will", "planned", "expected", "potential", “anticipated” and similar expressions are intended to identify these forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since the Company can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to vary materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Company's periodic filings with Canadian securities regulators and the United States Securities and Exchange Commission. Such forward-looking statements are based on various assumptions, including assumptions made with regard to the ability to advance exploration efforts at the Bullfrog Project; the results of such exploration efforts; the ability to secure adequate financing; the Company maintaining its current strategy and objectives; the Company’s ability to achieve its growth objectives; all approvals required for the Transaction being received; the Company completing satisfactory due diligence on the Reward Project. While the Company considers these assumptions to be reasonable, based on information currently available, they may prove to be incorrect. Except as required by applicable law, we assume no obligation to update or to publicly announce the results of any change to any forward-looking statement contained herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward- looking statements. If we update any one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. You should not place undue importance on forward-looking statements and should not rely upon these statements as of any other date. All forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission (“SEC”) limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. The historical technical report referenced in this press release uses the terms defined in Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). These standards are similar but not the same as reserves under subpart 1300 of Regulation S-K under the United States Securities Exchange Act of 1934, as amended, (“S-K 1300”). Under S-K 1300, the definitions of “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” are substantially similar to the corresponding CIM Definition Standards. However there are differences between the definitions and standards under S-K 1300 and those under the CIM Definition Standards. The historical mineral reserve and mineral resources contained in this press release do no constitute mineral reserves and resources under S-K 1300. Therefore there is no assurance that any future S-K 1300 compliant mineral reserve and mineral resource estimates will be similar as those reported under CIM Definition Standards as contained in the historical technical reports prepared under CIM Definition Standards.

1 A qualified person has not done sufficient work to classify the historical estimates as current mineral resources and reserves and the Company is not treating the historical estimates as current mineral resources and reserves. The technical report supporting the historical estimate was not filed on SEDAR.

2 Comprised of measured mineral resources of 168,800 ounces of gold grading 0.025 oz/t (0.86 g/t) gold and indicated mineral resources of 247,900 ounces of gold grading 0.021 oz/t (0.72 g/t) gold. Mineral resources are inclusive of mineral reserves.

3 Comprised of proven mineral reserves of 167,000 ounces of gold grading 0.026 oz/t (0.90 g/t) gold and probable mineral reserves of 210,000 ounces of gold grading 0.022 oz/t (0.75 g/t) gold.

4 Comprised of measured mineral resources of 527,000 ounces of gold grading 0.54 g/t gold and indicated mineral resources of 683,000 ounces of gold grading 0.52 g/t gold.