I agree to and consent to receive news, updates, and other communications by way of commercial electronic messages (including email) from Augusta Gold Corp. I understand I may withdraw consent at any time by clicking the unsubscribe link contained in all emails from Augusta Gold Corp.

Augusta Gold Announces Maiden Resource Estimate at Bullfrog Gold Project

Vancouver, British Columbia, July 14, 2021 – Augusta Gold Corp. (TSX:G; OTCQB:AUGG; FSE:11B) (“Augusta Gold” or the “Company”) is pleased to announce the results of the maiden Mineral Resource estimate for its Bullfrog Gold Project located in Nevada, USA.

Highlights

- Maiden Mineral Resource estimate for Bullfrog Gold project in Nevada supported by large dataset, including 254,542 metres of drilling in 1,287 holes, underpins brownfield heap leach development opportunity and sets baseline for expansion

- Measured and Indicated Mineral Resources of 880,000 ounces (95% oxide)

- Inferred Mineral Resources of 130,000 ounces (92% oxide)

- Future drill testing will target potential high-grade structurally-controlled vein material adjacent to historical underground mining

- Company continues to collect necessary data for geotechnical, metallurgical and hydrological characterization for accelerated permitting activities of this brownfield site

Scott Burkett, VP Exploration commented: “The robust resource, with over 85% of the mineralized material categorized as Measured and Indicated, represents a large pit-constrained mineralized resource that is amenable to low-cost heap leaching. Additionally, there are several exploration targets under evaluation which were not included in the current Mineral Resource estimate, and which have the potential to increase the Mineral Resource.”

The Mineral Resource estimate includes mineralized material along strike and down dip of three historically mined deposits: Bullfrog, Montgomery-Shoshone and Bonanza. The Mineral Resource estimate demonstrates there is a large volume of gold mineralized material outside of the historic open pits. These mineralized zones remain open and have the potential to add additional resources within and adjacent to the current $1,550 per gold ounce constrained pit shell. Drilling continues at Bullfrog with three drills testing exploration targets and collecting necessary data for geotechnical, metallurgical and hydrological characterization for accelerated permitting activities. These activities are well underway and, as a past producer with access to excellent infrastructure and on land that has patented claims, we remain on track to rapidly advance the project through development with our plan of operations expected to be submitted in early 2022.

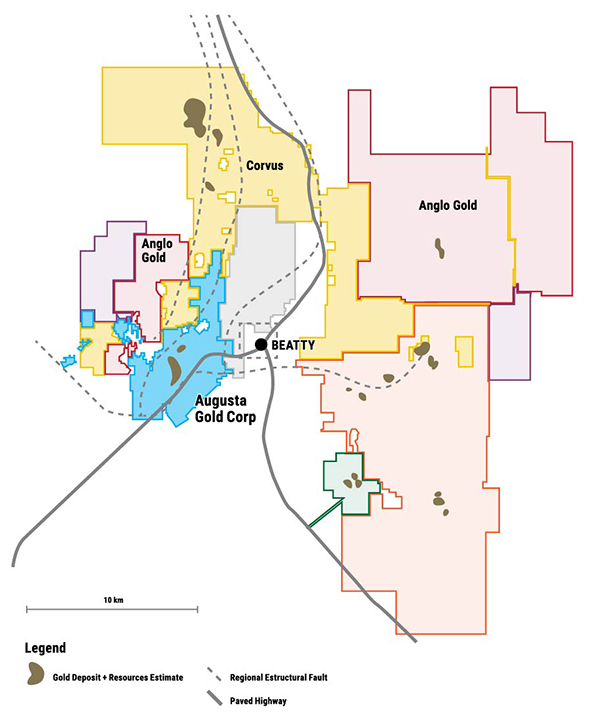

Figure 1: Location Map

Mineral Resource Estimate

The Mineral Resource estimate has an effective date of June 26, 2021, and is presented for each deposit area and in the form of a combined global oxide and sulphide Mineral Resource table below.

| Combined Global Resource - Oxide and Sulphide | |||||

| Classification | Tonnes (Mt) | Ag grade (g/t) | Au grade (g/t) | Ag Contained (koz) | Au Contained (koz) |

| Measured | 24.14 | 1.56 | 0.54 | 1,210.45 | 418.21 |

| Indicated | 28.15 | 1.30 | 0.51 | 1,180.18 | 461.58 |

| Measured and Indicated | 52.29 | 1.42 | 0.52 | 2,390.63 | 879.79 |

| Inferred | 9.02 | 0.84 | 0.45 | 243.56 | 129.98 |

Notes:

- Oxide estimated Mineral Resources are reported within a pit shell using the Lerch Grossman algorithm, a gold price of US$1,550/oz and a recovery of 82% for Au and silver price of US$20/oz and a recovery of 20% For Ag.

- Sulphide estimated Mineral Resources are reported within a pit shell using the Lerch Grossman algorithm, a gold price of US$1,550/oz and a recovery of 50% for Au and silver price of US$20/oz and a recovery of 12% for Ag. No sulphide material was reported for Montgomery-Shoshone or Bonanza. Figures are rounded to the appropriate level of precision for the reporting of Mineral Resources.

- Due to rounding, some columns or rows may not compute as shown.

- Estimated Mineral Resources are stated as in situ dry metric tonnes.

- The estimate of Mineral Resources may be materially affected by legal, title, taxation, socio-political, marketing, or other relevant issues.

- The Mineral Resource estimates are reported in compliance with the definitions and guidelines for the reporting of Exploration Information, Mineral Resources and Mineral Reserves in Canada, “the CIM Definition Standards on Mineral Resources and Reserves – Definitions and Guidelines” dated May 10, 2014 (CIM, 2014).

| Mineral Resource - Bullfrog | ||||||

| Redox | Classification | Tonnes (Mt) | Ag grade (g/t) | Au grade (g/t) | Ag Contained (koz) | Au Contained (koz) |

| Oxide | Measured | 17.87 | 1.33 | 0.54 | 763.11 | 311.71 |

| Indicated | 23.89 | 1.20 | 0.51 | 924.92 | 391.63 | |

| Measured and Indicated | 41.75 | 1.26 | 0.52 | 1,688.03 | 703.34 | |

| Inferred | 8.07 | 0.76 | 0.43 | 196.95 | 112.05 | |

| Sulphide | Measured | 0.87 | 1.12 | 0.70 | 31.36 | 19.49 |

| Indicated | 1.39 | 1.27 | 0.62 | 56.74 | 27.63 | |

| Measured and Indicated | 2.26 | 1.21 | 0.65 | 88.10 | 47.12 | |

| Inferred | 0.46 | 1.06 | 0.67 | 15.72 | 9.94 | |

| Total - Oxide and Sulphide | Measured | 18.74 | 1.32 | 0.55 | 794.47 | 331.20 |

| Indicated | 25.27 | 1.21 | 0.52 | 981.66 | 419.26 | |

| Measured and Indicated | 44.01 | 1.26 | 0.53 | 1,776.13 | 750.46 | |

| Inferred | 8.53 | 0.78 | 0.44 | 212.67 | 122.00 | |

| Mineral Resource - Montgomery-Shoshone | ||||||

| Redox | Classification | Tonnes (Mt) | Ag grade (g/t) | Au grade (g/t) | Ag Contained (koz) | Au Contained (koz) |

| Oxide | Measured | 3.01 | 3.74 | 0.56 | 362.00 | 53.78 |

| Indicated | 1.66 | 3.26 | 0.49 | 174.10 | 26.24 | |

| Measured and Indicated | 4.67 | 3.57 | 0.53 | 536.10 | 80.02 | |

| Inferred | 0.25 | 3.57 | 0.53 | 23.12 | 4.20 | |

| Mineral Resource - Bonanza | ||||||

| Redox | Classification | Tonnes (Mt) | Ag grade (g/t) | Au grade (g/t) | Ag Contained (koz) | Au Contained (koz) |

| Oxide | Measured | 2.39 | 0.70 | 0.43 | 53.99 | 33.23 |

| Indicated | 1.21 | 0.63 | 0.41 | 24.42 | 16.08 | |

| Measured and Indicated | 3.61 | 0.68 | 0.43 | 78.41 | 49.32 | |

| Inferred | 0.24 | 1.00 | 0.49 | 7.77 | 3.77 | |

QA/QC

To ensure reliable sample results, the Company has a rigorous QA/QC program in place that monitors the chain-of-custody of samples and includes the insertion of blanks and certified reference standards at statistically derived intervals within each batch of samples. Core is photographed and split in half with one-half retained in a secured facility for verification purposes.

Sample preparation (crushing and pulverizing) has been performed at Paragon Geochemistry (“Paragon”), an independent ISO/IEC accredited lab located in Sparks, Nevada. Paragon prepares a pulp of all samples for analysis at their analytical lab. Paragon analyzes the pulp sample by 30 g fire assay with an aqua regia digestion and ICP-OES finish, samples in which gold is greater than 3 ppm are re-run using fire assay with a gravimetric finish, reported in ppm. All samples are analyzed by multi-element aqua regia digestion (35AR-OES for 35 elements) with an ICP – OES finish.

In addition, the Company validated the historic gold and silver values by comparing the historic analytical certificates to the digital assay database. All available downhole surveys were digitized and utilized to properly plot analytical data down-hole. Drill holes with questionable data were omitted from the database and were not used to generation the mineral resource estimate. The results of the validation program indicate that the sample database is of sufficient accuracy and precision to be used for the generation of mineral resource estimates.

Qualified Person

The scientific and technical information contained in this news release and the sampling, analytical and test data underlying the scientific and technical information has been reviewed, verified and approved by Scott Burkett, Vice President, Exploration of Augusta Gold who is a “Qualified Person” under National Instrument 43-101- Standards of Disclosure for Mineral Projects. The data was verified using data validation and quality assurance procedures under high industry standards.

Enquiries

Lynette Gould, CFA

SVP, Investor Relations and Corporate Development

Telephone: 604.638.1468

Email: LGould@augustagold.com

About Augusta Gold

Augusta Gold is a rapidly growing exploration and development company focused on building a long-term business that delivers stakeholder value through developing the Bullfrog Gold Project and pursing accretive M&A opportunities. The Bullfrog Gold Project is located in the prolific Bullfrog district approximately 120 miles north-west of Las Vegas, Nevada and 4 miles west of Beatty, Nevada. The Company controls approximately 7,800 acres of mineral rights including the Bullfrog and Montgomery-Shoshone deposits and has further identified significant additional mineralization around the existing pits and defined several exploration targets that could further enhance the Project. The Company is led by a management team and board of directors with a proven track record of success in financing and developing mining assets and delivering shareholder value. For more information, please visit www.augustagold.com.

Forward Looking Statements

Certain statements and information contained in this new release constitute "forward-looking statements", and "forward-looking information" within the meaning of applicable securities laws (collectively, "forward-looking statements"). These statements appear in a number of places in this new release and include statements regarding our intent, or the beliefs or current expectations of our officers and directors, including exploration plans, that future drill testing will target potential high-grade structurally-controlled vein material adjacent to historical underground mining, that the mineralized resource is amenable to low-cost heap leaching, that there are several exploration targets under evaluation which were not included in the current Mineral Resource estimate and which have the potential to increase the Mineral Resource, that the Company continues to collect necessary data for geotechnical, metallurgical and hydrological characterization for accelerated permitting activities of the Bullfrog Project, that the mineralized zones at the Bullfrog Project remain open and have the potential to add additional resources within and adjacent to the current $1,550 per gold ounce constrained pit shell, that we remain on track to rapidly advance the project through development, and that our plan of operations is expected to be submitted in early 2022. When used in this news release words such as “to be”, "will", "planned", "expected", "potential", and similar expressions are intended to identify these forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since the Company can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to vary materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Company's periodic filings with Canadian securities regulators. Such forward-looking statements are based on various assumptions, including assumptions made with regard to the ability to advance exploration efforts at the Bullfrog Project; the results of such exploration efforts; the ability to secure adequate financing (as needed); the Company maintaining its current strategy and objectives; and the Company’s ability to achieve its growth objectives. While the Company considers these assumptions to be reasonable, based on information currently available, they may prove to be incorrect. Except as required by applicable law, we assume no obligation to update or to publicly announce the results of any change to any forward-looking statement contained herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward- looking statements. If we update any one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. You should not place undue importance on forward-looking statements and should not rely upon these statements as of any other date. All forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission (“SEC”) limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. The technical report referenced in this press release uses the terms defined in Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). These standards are not the same as reserves under the SEC’s Industry Guide 7 and may not constitute reserves or resources under the SEC’s newly adopted disclosure rules to modernize mineral property disclosure requirements (“SEC Modernization Rules”), which became effective February 25, 2019 and will be applicable to the Company in its annual report for the fiscal year ending December 31, 2021, unless otherwise applicable earlier. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits and government approvals must be filed with the appropriate governmental authority. Additionally, the technical report uses the terms “measured resources”, “indicated resources”, and “measured & indicated resources”. We advise U.S. investors that while these terms are Canadian mining terms as defined in accordance with NI 43-101, such terms are not recognized under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Mineral resources described in the technical report have a great amount of uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade, without reference to unit measures. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that any or all part of an inferred resource will ever be upgraded to a higher category. U.S. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into SEC Industry Guide 7 reserves.

Under the SEC Modernization Rules, the definitions of “proven mineral reserves” and “probable mineral reserves” have been amended to be substantially similar to the corresponding CIM Definition Standards and the SEC has added definitions to recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” which are also substantially similar to the corresponding CIM Definition Standard. However there are differences between the definitions and standards under the SEC Modernization Rules and those under the CIM Definition Standards and therefore once the Company begins reporting under the SEC Modernization Rules there is no assurance that the Company’s mineral reserve and mineral resource estimates will be the same as those reported under CIM Definition Standards as contained in the technical reports prepared under CIM Definition Standards.

Neither the Toronto Stock Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.